What is the MTF square-off policy?

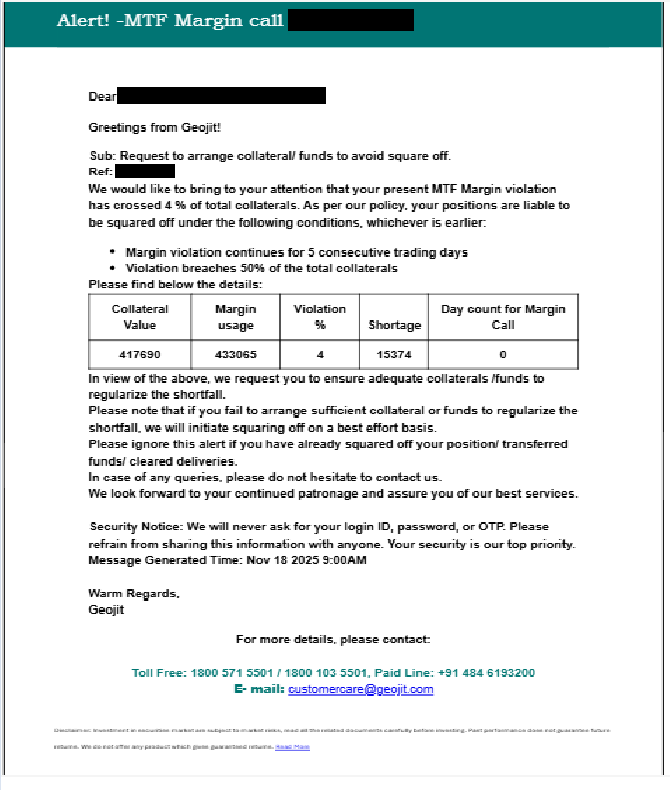

If there is a margin shortage in MTF, you will be intimated via email/SMS to bring in additional margins. This is known as an MTF Margin Call, the format as below

You may also receive an SMS stating : "Greetings from Geojit, Ref Trade Code, MTF Margin Violation is 2 pct. Violation above 50 pct may lead to squaring off positions. For details, check your registered email."

Once a margin call is received,

Geojit's Risk Management System (RMS) will automatically square off the MTF position under any of the following conditions, whichever occurs earlier:

- Margin violation continues for five consecutive trading days,

or

- The shortfall exceeds 50% of the total collaterals/funds in your account.

For example:

| Particulars | Amount |

|---|---|

| Purchase Value | Rs. 2,00,000 |

| Purchase Value | Rs. 50,000 |

| Min Margin Requirement | 25% (Rs. 50,000) |

- If there is a margin shortage, the client will receive an MTF Margin Call intimation. The client will be requested to bring in funds to cover the margin shortfall to avoid the position being squared off if further losses occur.

- If the margin shortage exceeds ₹25,000 (50% of ₹50,000), Geojit's RMS will automatically square off the client’s entire MTF open position without further notice.

- Even if the shortage decreases or remains below 50%, if the margin call is 5 days old, the square-off policy will still be applied to address the remaining shortage.

Still need help? Create Ticket