How can I pay my Income Tax online with Challan 280?

The Challan 280 is a way to pay your advance tax, regular assessment tax, self-assessment tax, additional charges, etc. online.

How to Pay Due Income Tax:

Step 1. Visit the official income tax department website

Step 2. Go to Services > e-payment Pay Taxes Online

Step 3. Select the relevant challan: ITNS 280 > Proceed

Step 4. Fill out and submit the challan details.

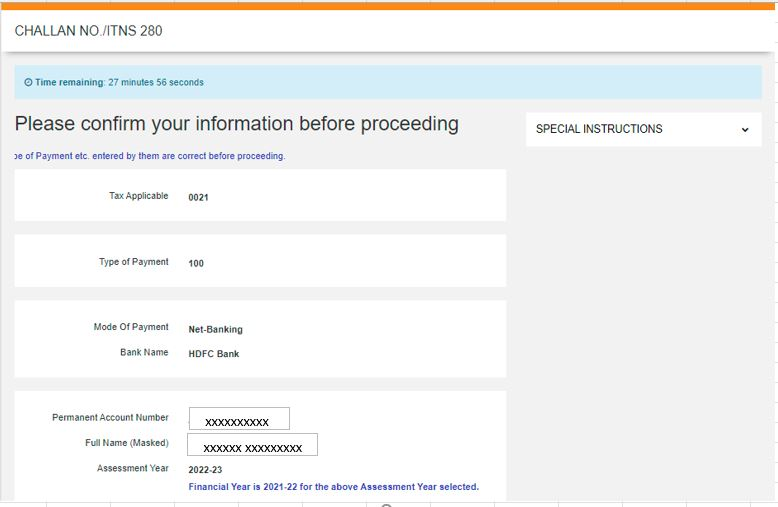

Step 5. Confirm and submit the data to the bank.

Step 6. You will be directed to the net-banking page of your bank. Log in and enter your payment details.

Step 7. On successful payment, a challan counterfoil will be displayed containing your CID (Customer ID). This counterfoil is proof of payment.

Still need help? Create Ticket